เอกสาร เสีย ภาษี

สัญญาภาษีสุรา ร้อยชักสาม ข้อ ๑. ว่า คนอยู่ในสับเยกต์ฝรั่งเศสเสียค่าธรรมเนียมร้อยชักสาม แล้วจะเอาสุราต่างประเทศซึ่งเป็นของกลั่นก็ดี ไม่ใช่ของกลั่นก็ดี บรรทุกด้วยกำปั่นประเทศใด ๆ เข้ามาในแผ่นดินสยามก็ได้ สุรานั้นมีผู้จะไปเที่ยวขายตามหัวเมืองก็ได้โดยสะดวก ไม่ห้าม ไม่ต้องเสียภาษีอีก เว้นแต่ที่กำหนดในข้อสัญญาที่ว่าใต้ลงมานี้ ข้อ ๒. ว่า ผู้ซึ่งจะเอาสุราต่างประเทศซึ่งเป็นของกลั่นก็ดี ไม่ใช่ของกลั่นก็ดี ไปขายปลีก ต้องของหนังสือลายเซ็น [1] สำหรับตัว แต่เจ้าพนักงานฝ่ายข้างไทยจะให้ขัดไม่ได้ ข้อ ๓. ว่า ถ้าจะขอลายเซ็นไปขายสุราซึ่งเป็นของกลั่นมีราคาต่ำกว่าลิตรหนึ่ง คิดเป็นเงินแฟรงค์หนึ่งเจ็ดสิบห้าเซนต์ เป็นเงินตราสองสลึง หนังสือลายเซ็นนั้นใช้ได้จำเพาะสำหรับโรงเดียวหรือเรือลำเดียวแลในเขตรกำหนดเมืองเดียว ข้อ ๔. ว่า ผู้จะเอาหนังสือลายเซ็นไม่ต้องเสียค่าเสมียน ค่าตรา ถ้าผู้เอาลายเซ็นเอาสุรามีราคาต่ำกว่าลิตรหนึ่ง คิดเป็นเงินแฟรงค์หนึ่งหกสิบห้าเซนต์ เป็นเงินตราสองสลึง ไปขายปลีก เจ้าพนักงานเรียกเอาค่าธรรมเนียมได้ปีหนึ่ง ไม่ให้เกินเงินแปดสิบบาท ถ้าผู้ขายสุราสูงเอาสุราราคาต่ำขายด้วยกัน ต้องเสียค่าลายเซ็นเหมือนกัน ข้อ ๕.

- คลินิกภาษีร้านถ่ายเอกสาร | MOF Tax Clinic - คลินิกภาษีกระทรวงการคลัง

- ไทยสถาปนากษัตริย์เขมร/เอกสาร 34 - วิกิซอร์ซ

คลินิกภาษีร้านถ่ายเอกสาร | MOF Tax Clinic - คลินิกภาษีกระทรวงการคลัง

- ขั้นตอนการต่อภาษีรถยนต์ 2565 มีวิธีอย่างไร ต้องเตรียมเอกสารอะไรบ้าง

- Honda adv 750 ราคา

- ไทยสถาปนากษัตริย์เขมร/เอกสาร 34 - วิกิซอร์ซ

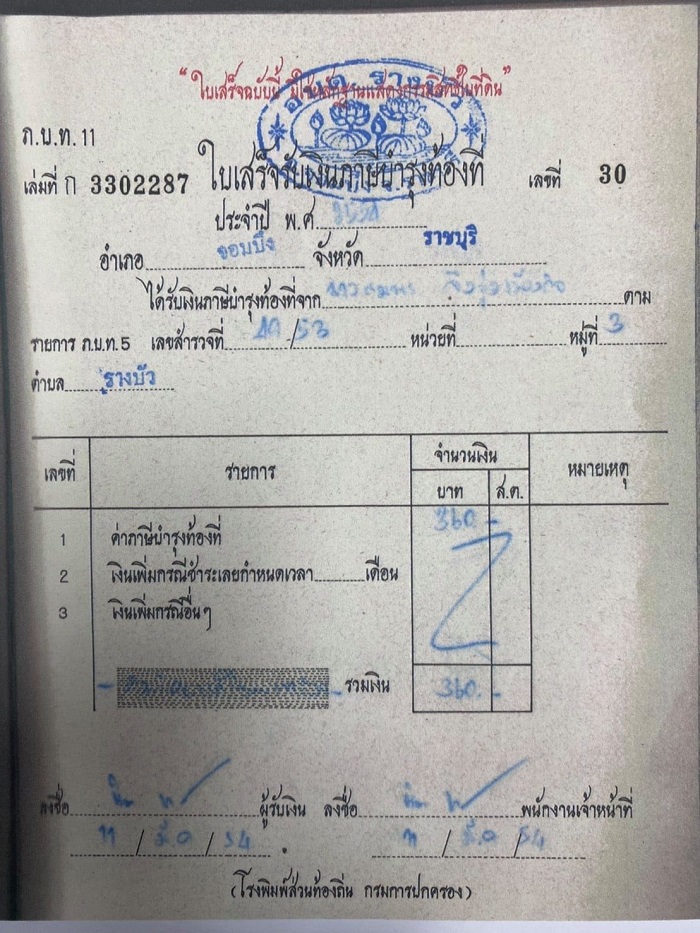

หนังสือรับรองการเสียภาษีเงินได้บุคคลธรรมดา (Income Tax Payment Certificate) เอกสารที่เกี่ยวข้อง 1. สำเนาแบบแสดงรายการภาษีที่ได้ยื่นชำระภาษีไว้ในประเทศไทย เช่น ภ. ง. ด. 90 หรือ ภ. 91 2. สำเนาใบเสร็จรับเงินค่าภาษีอากรที่กรมสรรพากรออกให้ 3. ภาพถ่ายบัตรประจำตัวผู้เสียภาษี 4. ภาพถ่ายหนังสือเดินทางของผู้เสียภาษี (ผู้เสียภาษีจะต้องอยู่ในประเทศไทยถึง 180 วัน ในปีภาษีที่จะรับรอง) 5. เอกสารอื่นที่เกี่ยวข้อง และจำเป็นแก่การพิจารณา (ถ้ามี) 6.

ที่ได้รับการรับรองจากกรมการขนส่งทางบก ซึ่งเจ้าของสามารถนำรถไปตรวจสภาพล่วงหน้าได้ไม่เกิน 3 เดือน ก่อนถึงวันสิ้นอายุภาษีประจำปี โดยมีอัตราค่าตรวจสภาพ ดังนี้ รถยนต์ที่มีน้ำหนักรถเปล่าไม่เกิน 2, 000 กิโลกรัม คันละ 200 บาท รถยนต์ที่มีน้ำหนักรถเปล่าเกิน 2, 000 กิโลกรัม คันละ 300 บาท สำหรับรถที่ไม่สามารถตรวจสภาพได้ที่ ตรอ.

ไทยสถาปนากษัตริย์เขมร/เอกสาร 34 - วิกิซอร์ซ

ง. ด. 94 ใน เดือนกันยายนสำหรับเงินได้ในเดือนมกราคม- มิถุนายน > ครั้งที่ 2 ยื่นตามแบบ ภ. 90 ใน เดือนมีนาคมของปีถัดไปสำหรับเงินได้ ใน เดือนมกราคม-ธันวาคม โดยนำภาษีที่จ่ายครั้งแรกมาหักออกจากภาษีที่คำนวณได้ใน ครั้งที่ 2 ภาษีเงินได้นิติบุคคล ต้องยื่นแบบชำระภาษีต่อกรมสรรพากร ณ สำนักงานสรรพากรพื้นที่สาขาในเขตท้องที่ ที่สถานประกอบการตั้งอยู่หรือทางอินเทอร์เน็ตปีละ 2 ครั้ง ได้แก่ > ภาษีเงินได้ครึ่งรอบระยะเวลาบัญชี ยื่นตามแบบ ภ. 51 ภายใน 2 เดือนนับตั้ง แต่วันครบ 6 เดือนของรอบระยะเวลาบัญชี > ภาษีเงินได้สิ้นรอบระยะเวลาบัญชี ยื่นตามแบบ ภ. 50 ภายใน 150 วัน นับ ตั้งแต่วันสุดท้ายของรอบระยะเวลาบัญชี โดย นำภาษีที่จ่ายในครึ่งรอบระยะเวลาบัญชีมาหักออกจากภาษีที่คำนวณได้เมื่อสิ้นรอบเวลา บัญชี > เราต้องเรียกเก็บภาษีมูลค่าเพิ่มจาก ผู้รับบริการและออกใบกำกับภาษีให้แก่ผู้รับ บริการ เมื่อได้รับชำระค่าบริการ > เราต้องเรียกเก็บภาษีมูลค่าเพิ่มจาก ผู้ซื้อและออกใบกำกับภาษีให้แก่ผู้ซื้อเมื่อส่ง มอบสินค้า > เรามีหน้าที่จัดทำรายงานสินค้าและ วัตถุดิบ รายงานภาษีขายและยื่นแบบภาษี มูลค่าเพิ่มตามแบบ ภ. พ. 30 ในแต่ละเดือน ภายในวันที่ 15 ของเดือนถัดไป สิทธิประโยชน์ทางภาษี • ผู้ประกอบการที่เป็นวิสาหกิจชุมชนที่มิใช่ นิติบุคคลและมีรายได้ไม่เกิน 1.